Director, Researcher, Multi-Asset Strategies & Solutions (MASS)

Locations: New York, New York

Overview of Investment Professional roles

Our investment professionals thrive in a culture that pushes them to question the status quo, overdeliver for clients, and work together to shape the future of the industry. At BlackRock, you’ll forge meaningful relationships within your team and across the firm – expanding your network as you tackle complex challenges with a collaborative approach, integrated research and risk management. In an environment that feels welcoming and inclusive, you’ll discover opportunities to hone your skills, develop new expertise, gain mentorship, and build the investment career you envision.

Job description

About this role

About the Company:

BlackRock is the largest asset-manager in the world and its mission is to help investors build better financial futures. As a fiduciary to investors and a leading provider of financial technology, our clients turn to us for the solutions they need when planning for their most important goals in life. As of [December 31, 2024, the firm managed approximately $10 trillion] in assets on behalf of investors worldwide. BlackRock helps clients around the world meet their goals with a range of products that include separate accounts, mutual funds, iShares® (exchange-traded funds), and other pooled investment vehicles. BlackRock also offers risk management, advisory and enterprise investment-system services to a broad base of institutional investors through BlackRock Solutions®. As of [December 31, 2024, the firm had over 20,000 employees in more than 35 countries] and is a major presence in all global markets. For additional information on BlackRock, please visit www.blackrock.com | Twitter: @blackrock | Blog: www.blackrockblog.com | LinkedIn: www.linkedin.com/company/blackrock

Business Overview:

A multi-asset strategy combines different types of assets, such as stocks, bonds, cash, and derivatives to create efficient solutions for investors. The BlackRock Multi-Asset Strategies and Solutions group’s capabilities include tactical asset allocation, factor-based strategies, income, target date, target risk, and impact investing. Our global team of over [300] investment professionals delivers these capabilities across a range of pooled vehicles, model portfolios, and customized mandates for a diversified client base. Currently, MASS has over [$1 trillion] in assets under management, with a global footprint in San Francisco, New York, London, Hong Kong, and other locations throughout the world.

Role Description:

BlackRock is seeking an experienced Researcher with a strong background in manager research across the full range of active strategies; this role will be based in New York. Experience with multi-asset portfolio construction is a strong plus, and Python programming is a plus. The person in this role will partner closely with BlackRock’s Model Portfolio Solutions and Outsourced CIO businesses within MASS, providing quantitative analysis and insights on BlackRock funds to OCIOs and solutions-builders in MASS. The role will also involve close collaboration with the Blackrock Manager Research group to bring their research and insights on third-party funds into BlackRock’s solutions for clients. The successful candidate will have an advanced degree in finance and/or economics and a good understanding of financial markets and active investing.

Key Responsibilities:

Lead manager research on BlackRock’s internal active funds with a focus on qualitative assessment, interviews and data-driven insights.

Deliver actionable manager research insights on BlackRock funds to solutions builders and portfolio managers in MASS.

Utilize quantitative metrics to assess third party managers and collaborate with the BlackRock Manager Research (BMR) group to deliver actionable manager research insights on third-party managers to solutions builders and portfolio managers, including CMS.

Remain current on developments in local and global financial markets and economics.

Collaborate on the development of new products and solutions for global investors.

Build partnerships and strong working relationships with internal and external stakeholders.

Skills and Qualifications:

Bachelor’s degree required, and postgraduate degree/CFA/FRM preferred.

Over 10 years’ experience in manager research across a range of investment strategies.

Familiar with financial markets including equity, bond, and derivative markets.

Creativity and capability to move ideas to implementable investment insights.

Successful investment track record in asset-allocation utilizing manager research insights a strong plus.

Knowledge of both fundamental and quantitative investment theory and practice a plus.

Excellent English-language communication and presentation skills.

Familiar with Bloomberg, good programming skills and experience, Python language a plus.

Must possess a strong work ethic and must be a team player with the ability to work well under pressure.

Our benefits

To help you stay energized, engaged and inspired, we offer a wide range of benefits including a strong retirement plan, tuition reimbursement, comprehensive healthcare, support for working parents and Flexible Time Off (FTO) so you can relax, recharge and be there for the people you care about.

Our hybrid work model

BlackRock’s hybrid work model is designed to enable a culture of collaboration and apprenticeship that enriches the experience of our employees, while supporting flexibility for all. Employees are currently required to work at least 4 days in the office per week, with the flexibility to work from home 1 day a week. Some business groups may require more time in the office due to their roles and responsibilities. We remain focused on increasing the impactful moments that arise when we work together in person – aligned with our commitment to performance and innovation. As a new joiner, you can count on this hybrid model to accelerate your learning and onboarding experience here at BlackRock.

About BlackRock

At BlackRock, we are all connected by one mission: to help more and more people experience financial well-being. Our clients, and the people they serve, are saving for retirement, paying for their children’s educations, buying homes and starting businesses. Their investments also help to strengthen the global economy: support businesses small and large; finance infrastructure projects that connect and power cities; and facilitate innovations that drive progress.

This mission would not be possible without our smartest investment – the one we make in our employees. It’s why we’re dedicated to creating an environment where our colleagues feel welcomed, valued and supported with networks, benefits and development opportunities to help them thrive.

For additional information on BlackRock, please visit @blackrock | Twitter: @blackrock | LinkedIn: www.linkedin.com/company/blackrock

BlackRock is proud to be an equal opportunity workplace. We are committed to equal employment opportunity to all applicants and existing employees, and we evaluate qualified applicants without regard to race, creed, color, national origin, sex (including pregnancy and gender identity/expression), sexual orientation, age, ancestry, physical or mental disability, marital status, political affiliation, religion, citizenship status, genetic information, veteran status, or any other basis protected under applicable federal, state, or local law. View the EEOC’s Know Your Rights poster and its supplement and the pay transparency statement.

BlackRock is committed to full inclusion of all qualified individuals and to providing reasonable accommodations or job modifications for individuals with disabilities. If reasonable accommodation/adjustments are needed throughout the employment process, please email Disability.Assistance@blackrock.com. All requests are treated in line with our privacy policy.

BlackRock will consider for employment qualified applicants with arrest or conviction records in a manner consistent with the requirements of the law, including any applicable fair chance law.R255982

BlackRock Principles

We look to hire people that will embody our BlackRock Principles:

-

We are a fiduciary to our clients.

This is the bedrock of our identity; it reflects our integrity and the unbiased advice we give our clients.

-

We are One BlackRock.

We work collaboratively to create the best outcomes for our clients, our firm and the communities where we operate.

-

We are passionate about performance.

We are relentless in innovating and finding better ways to serve our clients and improve our firm.

-

We take emotional ownership.

We have a deep sense of responsibility to our clients and to each other.

-

We are committed to a better future.

We are long-term thinkers, focused on helping people build a better tomorrow.

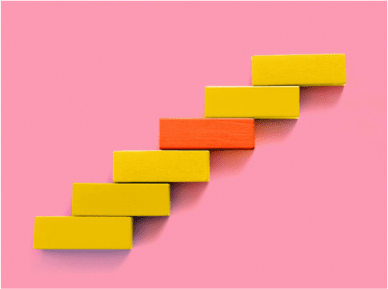

Career path

Our people drive our business forward every day. That's why we're committed to helping you build an extraordinary career at the firm. In addition to supporting your vertical growth along corporate titles, we’ll help you expand your horizons across the firm – with opportunities to collaborate with unexpected colleagues, take on unique assignments outside of your regular business, and even move internally within BlackRock.

-

Analyst

-

Associate

-

Vice President

-

Director

-

Managing Director

-

Senior Managing Director

Benefits

We care about your overall well-being and design our benefits package to support you in various aspects of your life.

-

Financial well-being

We offer resources designed to help you build a sound financial future for you and your family, like retirement savings plans and tuition reimbursement.

-

Pay for performance

Our pay-for-performance philosophy includes a base salary and a discretionary annual bonus.

-

Physical well-being

Our healthcare plans and resources help you focus on your physical health, so you and your family can feel your best.

-

Emotional well-being

We support our people's mental health and emotional well-being by providing access to an Employee Assistance Program and a network of Mental Health Ambassadors.

-

Life management

You'll be able to focus on moments that are important to you with benefits designed to support life in and outside of work with Flexible Time Off, parental leave and more.

Stay in the know

Sign up to get information on open roles, upcoming events and life at the firm – straight to your inbox.