Security Modeling Associate

Locations: London, United Kingdom

Overview of Technology roles

At BlackRock, technology has always been at the core of what we do – and today, our technologists continue to shape the future of the industry with their innovative work. We are not only curious but also collaborative and eager to embrace experimentation as a means to solve complex challenges. Here you’ll find an environment that promotes working across teams, businesses, regions and specialties – and a firm committed to supporting your growth as a technologist through curated learning opportunities, tech-specific career paths, and access to experts and leaders around the world.

Job description

About this role

We are seeking a highly motivated Associate to join the Credit Modeling Team within AFE Single Security. This role is ideal for someone with a strong foundation in quantitative research, econometrics, and a passion for solving complex problems through innovation and collaboration.

As part of our team, you will contribute to the development of next-generation financial models that directly support trading and portfolio management decisions. These models are built using cutting-edge techniques in data science, machine learning, and statistical modeling, and are deployed on scalable platforms using technologies.

Model Research and Development:

Design, develop, and continuously enhance BlackRock’s Credit Risk Modeling Suite, covering private and public credit markets. This includes models for Probability of Default (PD), Loss Given Default (LGD), and Ratings Migration, calibrated to reflect the distinct characteristics of each market segment.

Integrate issuer-specific, deal-specific, and market-driven factors into model frameworks, capturing the nuances of corporate bonds, structured products, and private credit transactions such as direct lending and bespoke financing.

Stay at the forefront of academic research, regulatory developments, and industry best practices across investment-grade, high-yield, and private debt, translating insights into actionable model enhancements.

Contribute to the full lifecycle of credit risk models—from conceptualization and prototyping to validation, deployment, and ongoing performance monitoring—ensuring models remain robust, transparent, and fit-for-purpose.

Apply advanced statistical, econometric, and machine learning techniques to address challenges such as data sparsity, non-linear risk dynamics, and illiquidity premiums, especially prevalent in private markets.

Conduct rigorous model validation, benchmarking, and back-testing using diverse datasets, including market data, proprietary deal-level information, and external benchmarks.

Implement models in Python within the Aladdin platform, ensuring seamless integration with portfolio analytics, risk reporting, and investment decision tools.

Continuously enhance modeling infrastructure and workflows by leveraging automation, cloud-native technologies, and scalable data pipelines to improve efficiency and reproducibility.

Drive innovation by incorporating alternative data sources (e.g., ESG metrics, covenant compliance, private financials) and AI/ML techniques to improve predictive accuracy and expand model coverage.

Serve as a thought leader and subject matter expert, contributing to internal forums, client engagements, and cross-functional initiatives to promote model adoption and elevate credit analytics across the firm.

Skills & Qualifications:

Demonstrated knowledge of credit modeling methodologies, such as structural models (e.g., Merton-type frameworks) and credit rating migration models. Experience with private credit modeling is considered beneficial.

Requires Master’s degree with 1-3 years, or bachelor’s degree with 3–5 years, of practical experience in developing and applying financial econometric models, emphasizing predictive analytics and quantitative risk frameworks.

PhD in quantitative fields such as Econometrics, Finance, Mathematics, Statistics, Computer Science, Data Science, or Financial Engineering in lieu of master’s degree with 2+ years also accepted. CFA or FRM certification preferred.

Advanced programming capabilities in Python, R, with practical experience in statistical computing, econometric analysis, and model deployment.

Strong conceptual grasp of financial market dynamics and the ability to contextualize quantitative insights within real-world macroeconomic and microstructural phenomena.

Exceptional verbal and written communication skills in English, with the ability to articulate complex quantitative concepts to both technical and non-technical stakeholders and external clients.

High degree of adaptability, intellectual curiosity, and professional maturity to thrive in a fast-paced, evolving environment. Proven ability to deliver high-quality output under tight deadlines.

Our benefits

To help you stay energized, engaged and inspired, we offer a wide range of employee benefits including: retirement investment and tools designed to help you in building a sound financial future; access to education reimbursement; comprehensive resources to support your physical health and emotional well-being; family support programs; and Flexible Time Off (FTO) so you can relax, recharge and be there for the people you care about.

Our hybrid work model

BlackRock’s hybrid work model is designed to enable a culture of collaboration and apprenticeship that enriches the experience of our employees, while supporting flexibility for all. Employees are currently required to work at least 4 days in the office per week, with the flexibility to work from home 1 day a week. Some business groups may require more time in the office due to their roles and responsibilities. We remain focused on increasing the impactful moments that arise when we work together in person – aligned with our commitment to performance and innovation. As a new joiner, you can count on this hybrid model to accelerate your learning and onboarding experience here at BlackRock.

About BlackRock

At BlackRock, we are all connected by one mission: to help more and more people experience financial well-being. Our clients, and the people they serve, are saving for retirement, paying for their children’s educations, buying homes and starting businesses. Their investments also help to strengthen the global economy: support businesses small and large; finance infrastructure projects that connect and power cities; and facilitate innovations that drive progress.

This mission would not be possible without our smartest investment – the one we make in our employees. It’s why we’re dedicated to creating an environment where our colleagues feel welcomed, valued and supported with networks, benefits and development opportunities to help them thrive.

For additional information on BlackRock, please visit @blackrock | Twitter: @blackrock | LinkedIn: www.linkedin.com/company/blackrock

BlackRock is proud to be an Equal Opportunity Employer. We evaluate qualified applicants without regard to age, disability, race, religion, sex, sexual orientation and other protected characteristics at law.

R257842

BlackRock Principles

We look to hire people that will embody our BlackRock Principles:

-

We are a fiduciary to our clients.

This is the bedrock of our identity; it reflects our integrity and the unbiased advice we give our clients.

-

We are One BlackRock.

We work collaboratively to create the best outcomes for our clients, our firm and the communities where we operate.

-

We are passionate about performance.

We are relentless in innovating and finding better ways to serve our clients and improve our firm.

-

We take emotional ownership.

We have a deep sense of responsibility to our clients and to each other.

-

We are committed to a better future.

We are long-term thinkers, focused on helping people build a better tomorrow.

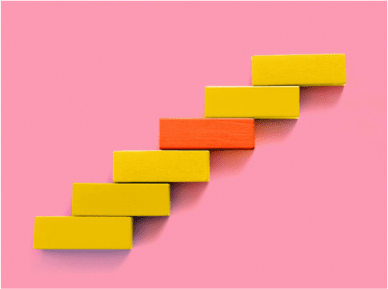

Career path

We recognize that our technologists benefit from a tailored approach to navigating and advancing their careers in the ways they envision. Our tech career paths are specifically built to support vertical and horizontal trajectories – including Enterprise Leadership (team manager) and Tech Leadership (individual contributor) ‘tracks’ as well as various other career moves.

-

Engineer I (Analyst)

-

Engineer II/III (Associate)

-

Senior Engineer I/II (Vice President)

-

Lead Engineer

(Vice President)Engineering Team Manager

(Vice President) -

Principal/Sr. Principal

Engineer (Director)Engineering Team Director/ Sr. Engineering Team Director -

Managing DirectorManaging Director

-

TECH

LEADERSHIPENTERPRISE

LEADERSHIP

Benefits

We care about your overall well-being and design our benefits package to support you in various aspects of your life.

-

Financial well-being

We offer resources designed to help you build a sound financial future for you and your family, like retirement savings plans and tuition reimbursement.

-

Pay for performance

Our pay-for-performance philosophy includes a base salary and a discretionary annual bonus.

-

Physical well-being

Our healthcare plans and resources help you focus on your physical health, so you and your family can feel your best.

-

Emotional well-being

We support our people's mental health and emotional well-being by providing access to an Employee Assistance Program and a network of Mental Health Ambassadors.

-

Life management

You'll be able to focus on moments that are important to you with benefits designed to support life in and outside of work with Flexible Time Off, parental leave and more.

Stay in the know

Sign up to get information on open roles, upcoming events and life at the firm – straight to your inbox.